8 Best Financial Modeling Courses For 2024

Are you looking to elevate your career in finance or perhaps gain a deeper understanding of your business’s financial health? Welcome to the world of financial modeling – a crucial skill that can open doors to exciting opportunities and give you a competitive edge in today’s dynamic business landscape.

As an FP&A professional, I have tested more than 30 courses to help train my analysts. My meticulously curated list includes industry-leading platforms like Udemy, Coursera, and Wall Street Prep. I’ll unpack each course, providing insights into course content, instructor credibility, user reviews, and more.

By the end of this article, you’ll discover which course aligns with your career goals and understand why financial modeling is a game-changer in decision-making processes. So, are you ready to invest in your financial education and step up your game? Let’s dive in!

The Best Financial Modeling Courses

After extensive research and testing (and a lot of nail-biting exams), I’ve compiled a list of my 8 favorite financial modeling courses that offer a solid foundation and advanced skills in this field:

1) Udemy’s Introduction to Financial Modeling

This course is designed to help beginners understand the essentials of financial modeling using Excel and build a fully integrated financial model from scratch.

Students will be able to understand the financial modeling process, analyze financial statements, and confidently use Excel for financial modeling.

Pros:

- Comprehensive: The course covers essential topics in financial modeling, making it a great starting point for beginners.

- Practical: The course offers practical examples and case studies, allowing students to apply their learning in real-world scenarios.

- Flexible: As with all Udemy courses, you can learn at your own pace and on your own schedule.

Cons:

- Limited Advanced Topics: The course is an introduction to financial modelling, so it may not delve deeply into advanced topics.

- Dependent on Instructor Support: The quality of the learning experience can depend on the level of support provided by the instructor.

Pricing:

The rack rate on this course is $84.99, but Udemy frequently runs sales. I have seen this course as low as $17.99!

Who Its Best For:

The course is best suited for beginners and those new to financial models. It’s perfect if you’re looking to dip your toes into the finance waters without getting overwhelmed by the waves. So whether you’re a small business owner trying to make sense of your finances, a budding entrepreneur planning your next venture, or just a curious learner, this course has something to offer you.

2) Coursera’s Business And Financial Modeling From Wharton

Coursera’s Business and Financial Modeling Specialization, offered in collaboration with the University of Pennsylvania’s Wharton School, is a comprehensive program designed to equip learners with the skills needed to make data-driven financial decisions. This course introduces you to spreadsheet models, modeling techniques, common investment analysis, and company valuation applications.

In this course, you’ll construct a data model and recommend a business strategy based on it, offering a hands-on learning experience that bridges theory and practice. It’s like building your own financial compass to navigate the vast oceans of business decision-making!

Pros

- Universally Recognized: The prestigious Wharton School created the course, lending credibility and recognition to your learning journey.

- Comprehensive: Covering a wide array of topics, from basic spreadsheet models to complex financial decisions, this course offers a holistic learning experience.

- Practical Application: The capstone project allows you to apply what you’ve learned in a real-world context.

Cons

- Potential Time Commitment: As a comprehensive course, it may require a significant time commitment to complete all modules and the capstone project.

- Advanced Content: Some beginners might find the content challenging if they lack a basic understanding of financial concepts.

Pricing

You can audit the course for free! Coursera subscriptions start at $39.99 per month if you want a certificate or to complete the hands-on learning project.

Who It’s Best For

This course is an excellent fit for those who are serious about diving deep into the world of financial models and data analysis. Whether you’re a finance professional looking to upskill, a business owner trying to make informed decisions, or an ambitious student aiming for a career in finance, this course can be your stepping stone to success.

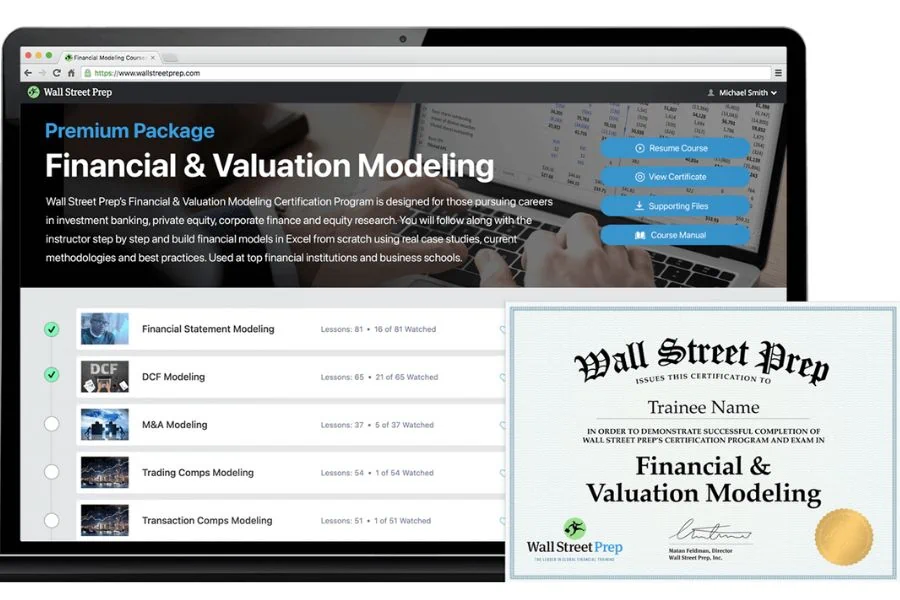

3) Wall Street Prep’s Premium Modeling Package

Picture this: You’re standing at the base of a mountain called “Financial Modeling,” and you’re about to embark on an adventurous climb toward the peak of knowledge. That’s where Wall Street Prep’s Premium Modeling Package comes in. It’s your trusty guide, equipped with all the necessary tools to maneuver this challenging terrain.

This comprehensive program is designed to help you master financial modelling, including DCF (Discounted Cash Flow), Comps (Comparable Company Analysis), M&A (Mergers & Acquisitions), LBO (Leveraged Buyout), and Financial Statement Modeling. With its step-by-step approach, you’ll be scaling that mountain in no time!

Pros

- Thorough: The course covers a broad array of topics, giving you a comprehensive view of financial modeling.

- Practical: The course offers real-world examples, allowing for practical application of theoretical knowledge.

- Accessible: As a self-paced course, you can learn whenever and wherever suits you best.

Cons

- Intensive: Considering the depth and breadth of the material covered, this course may require a substantial time investment.

- Pricey: Compared to other courses, the cost might be a barrier for some learners.

Pricing

Regarding pricing, this premium package is listed at $499. While not exactly pocket change, consider it an investment in your future – a ticket to the VIP lounge of financial know-how!

Who It’s Best For

This course is ideal for those who are serious about making their mark in the finance world. Whether you’re an aspiring investment banker, an ambitious private equity analyst, a corporate finance professional, or an equity researcher, this course can be your launchpad to success.

4) Wall Street Oasis’s Elite Modeling Course

Imagine you’re about to embark on a grand voyage across the vast ocean of financial modeling. Wall Street Oasis’s Elite Modeling Course is like your steadfast ship, equipped with all the necessary navigational tools to weather any storm.

This comprehensive course is designed to transform you into a master mariner of financial modelling. It guides you step-by-step through Excel modeling, Discounted Cash Flow (DCF), M&A, and more, all taught by an elite investment bankers.

Pros

- Thorough: The course covers many topics, making it a comprehensive guide to financial modeling and data analysis.

- Practical: The course offers practical examples and real-world scenarios, bridging the gap between theory and practice.

- Flexible: This is a self-paced course, meaning you can set sail whenever you’re ready and navigate at your own speed.

Cons

- Time Commitment: Given the depth of the material covered, this course may require a significant time investment.

- Cost: The course might be a touch pricey for some learners, although many would argue that the knowledge gained is worth its weight in gold.

Pricing

As for pricing, the Elite Modeling Package is currently listed at $497. While it may seem like a treasure chest full of doubloons, remember that investing in your education is akin to discovering a buried treasure of knowledge!

Who It’s Best For

This course is a perfect fit for those ready to navigate the turbulent waters of the finance world. Whether you’re an aspiring investment banker, a private equity professional, or simply someone with a thirst for financial knowledge, this course can be your compass pointing the way to success.

So, ready to hoist the anchor and set sail on a journey of financial discovery? With Wall Street Oasis’s Elite Modeling Course as your ship, you will surely reach the shores of success.

5) CFI’s Financial Modeling & Valuation Analyst (FMVA) Certification

The Corporate Finance Institute (CFI) manages this certification. Think of this course as a personal trainer for your finance skills, helping you to build strength in practical financial analysis without breaking a sweat.

This certification program covers everything from financial modeling and business valuation to financial analysis and mastering Excel. It’s like a buffet of financial knowledge where you can fill your plate with all the essential skills you need to stand out as a world-class financial analyst.

Pros

- Comprehensive: The course covers a wide range of topics, making it a one-stop shop for all your financial model needs.

- Practical: With a focus on practical applications, this course ensures you can immediately put your new skills to work.

- Flexible: As a self-paced online program, you can learn at your own speed, anytime, anywhere.

Cons

- Time Commitment: With over 28 courses included, completing this certification might require a sizeable chunk of your time.

- Cost: Some learners might find the price tag a bit steep, although many would agree that the value of the knowledge gained far outweighs the cost.

Pricing

The self-study program is $497 for a year and the full immersion course with personalized feedback is $847 for a year.

Who It’s Best For

Corporate Finance Institute targets this course to anyone aiming to become a financial analyst or hone their financial modeling and valuation skills. Whether you’re just starting out in your finance career or looking to level up, this certification program can help you hit your targets.

6) Udemy’s Financial Modeling for Startups & Small Businesses

This course will equip participants with the practical skills needed to build robust financial models and forecasts for their startup businesses. The course covers a wide range of topics, including modeling user growth, revenue, expenses, financial analysis, data analysis, and more.

Pros

- Practical: The course provides real-world examples and hands-on exercises, ensuring that you can apply your learning directly to your business.

- Flexible: As an online course, you can learn at your own pace and revisit the material whenever you need to.

- Broad Scope: The course covers all critical aspects of financial modeling for startups, from user growth to revenue and expense modeling.

Cons

- Varied Quality: As with many Udemy courses, the quality can vary depending on the instructor.

- Limited Interaction: There may be limited opportunities for interaction with the instructor or other students, impacting the learning experience.

Pricing

The rack rate on this course is $99.99, but Udemy frequently runs sales. I have seen this course as low as $19.99!

Who It’s Best For

This course is ideal for startup entrepreneurs and small business owners who want to understand financial models and financial statements. It’s also suitable for non-finance professionals interested in learning how to model and forecast financials for their businesses.

7) Financial Edge’s The Modeler Course

Financial Edge’s “The Modeler” course is a comprehensive online program providing hands-on financial modeling experience. The course covers many topics, including Excel shortcuts, revision techniques, financial analysis, basic accounting principles like the income statement and balance sheet, valuation, and more. It aims to equip students with the practical skills needed in the finance industry.

Pros

- Practicality: The course offers practical examples and exercises, enabling students to apply their learning directly to real-world scenarios.

- Quality: Financial Edge is recognized as Wall Street’s #1 training provider, ensuring high-quality course content.

- Comprehensiveness: The course provides extensive coverage of financial modeling, making it a one-stop-shop for all your learning needs.

Cons

- Pricing: The cost of the course may be a barrier for some students. However, the price reflects the depth and quality of the content provided.

- Time Commitment: The course might require a significant time commitment due to the breadth of topics covered.

Pricing

This course is available for $239 including a completion certificate.

Who It’s Best For

“The Modeler” course is ideal for individuals looking to build or enhance their skills in financial modeling, whether they’re new investment bankers or aspiring financial analysts. Essentially, anyone who wishes to understand quantitative modeling can benefit from this course.

Overall, Financial Edge’s “The Modeler” course provides a practical and comprehensive guide to financial modeling, which can be a valuable tool for anyone looking to succeed in the finance industry.

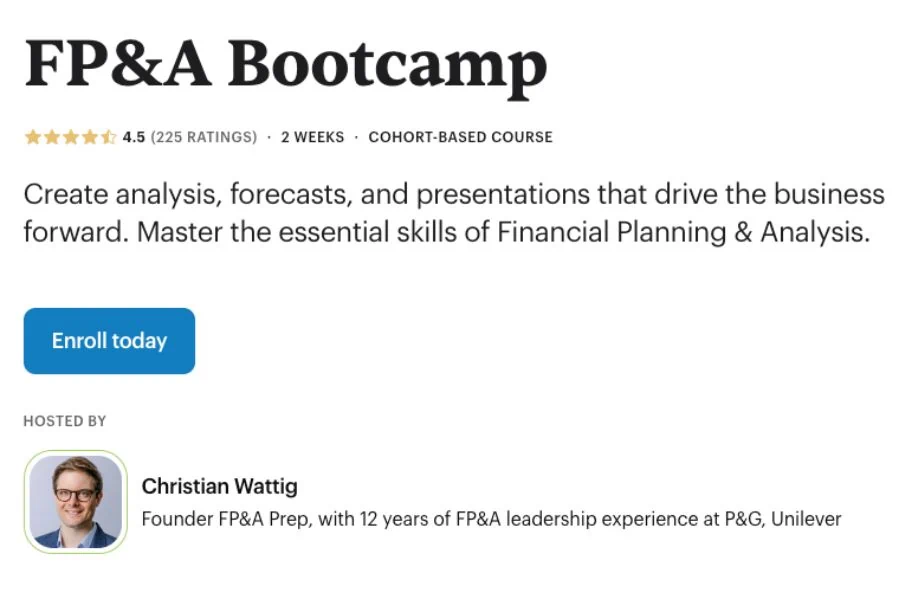

8) Christian Wattig’s FP&A Bootcamp

Christian Wattig’s FP&A Bootcamp is a live online course delivered via Zoom. The course, structured as an interactive workshop, is designed to impart practical Financial Planning and analysis (FP&A) skills that participants can apply immediately. Over the course of two weeks, participants engage in four workshops that include breakout room discussions, financial analysis, case studies, and role-playing exercises.

Pros

- Interactive Learning: The course provides a highly interactive learning experience with breakout room discussions and role-playing exercises.

- Real-Time Instruction: Participants receive real-time instruction from Christian Wattig, a seasoned FP&A leader with 12+ years of experience in multinational consumer goods companies and fast-growing tech startups.

- Practical Skills: The course equips participants with practical FP&A skills they can apply immediately in their roles.

Cons

- Limited Self-Paced Learning: As the course is live online, it may not offer the same flexibility as self-paced online courses.

- Time Commitment: The course is spread over two weeks, which might require a significant time commitment.

Pricing

This live, expert-led class is taught over Zoom and costs $1,200.

Who It’s Best For

Christian Wattig’s FP&A Bootcamp is specifically designed for full-time professionals who want to enhance their FP&A skills. It’s ideal for corporate finance teams, business leaders, and anyone working in financial planning and analysis who needs to understand and apply these skills in their roles.

What Is Financial Modeling?

Financial modeling plays a crucial role in corporate decision-making, empowering businesses to foresee the potential consequences of economic events and investment choices. It involves crafting a mathematical framework representing a financial scenario or a series of projected financial outcomes. This tool enables organizations to make informed decisions by analyzing and evaluating the financial implications of their choices.

These models can be used for various purposes, including business valuation, scenario planning, cost-effectiveness analysis, budgeting, forecasting, and strategic planning.

Financial models are built using advanced modeling software or a spreadsheet program like Excel. The process requires a deep understanding of financial data, accounting principles, and complex mathematical functions. It’s not just about crunching numbers – it’s about interpreting and presenting them in a way that’s accessible and valuable to decision-makers.

What to Look for in a Financial Modeling Course

When selecting a financial modeling course, the first thing to consider is the content of the course. It should cover essential topics such as Excel functions and formulas, financial statement analysis, valuation techniques, and financial forecasting. A well-rounded course will also explore more advanced topics like sensitivity analysis, scenario planning, and Monte Carlo simulations.

Practical application is key in learning, so look for courses that provide real-world case studies and hands-on exercises. These will help you understand how the theoretical aspects are applied in a business context.

Instructor Credibility

Look for instructors who have worked in roles such as financial analysts, investment bankers, or financial consultants. Their real-world experience will enrich the course content and provide valuable industry insights.

User Reviews and Ratings

User reviews and ratings can give you a sense of the course’s effectiveness and the quality of instruction. Look for courses with high ratings and read through the reviews to understand what past students liked and disliked about the course.

However, don’t rely solely on the overall rating. Pay attention to the comments about the course’s difficulty level, the clarity of instruction, and the applicability of the course content in a real-world setting.

Certifications and Accreditations

Lastly, consider whether the course offers a certification upon completion. While learning the skill is more important than the certificate itself, having a certification from a respected institution can enhance your resume and demonstrate your commitment to professional development.

Frequently Asked Questions

How do I teach myself financial modeling?

You can teach yourself financial modeling by first gaining proficiency in Excel, the primary tool for building financial models. Then, understand the basics of finance and accounting like the income statement, balance sheet, and cash flow statement. You can also use online templates and case studies for practice.

Which is better, CFA or financial modeling?

Choosing between a CFA (Chartered Financial Analyst) designation and financial modeling largely depends on your career goals. A CFA might be more beneficial if you’re aiming for roles in investment banks, portfolio management, or equity research. However, financial modeling could be more useful if you’re looking at roles in investment banking, corporate finance, or private equity.

Is financial modeling certification worth it?

A financial modeling certification can provide a structured way to learn the necessary skills and demonstrate your knowledge to potential employers. It can be particularly valuable if you’re trying to break into a field like investment banking or private equity firms, where advanced financial modeling skills are crucial.

How can I learn financial modeling?

You can learn through online courses, boot camps, or self-study. Many reputable organizations offer comprehensive courses that cover the basics of financial modeling, including Microsoft Excel proficiency, accounting, and building your own financial models.

Are financial modeling courses worth it?

Yes, financial modeling courses can be very beneficial. They can help you understand complex financial situations, make informed decisions, and increase your marketability in the job market. However, the value can depend on your specific career goals and current level of knowledge.

How long is the financial modeling course?

The length of a financial modeling course can vary greatly depending on the format and depth of the course. Some intensive boot camps might last a few days or weeks, while online self-paced courses could take several months to complete.

Can you teach yourself financial modeling?

Yes, you can teach yourself financial modeling. It requires a solid understanding of Excel and basic financial concepts. Many resources, including free templates and tutorials, are available online to help you get started.

Is it hard to learn financial modeling?

Learning financial modeling can be challenging as it requires a good understanding of financial concepts and proficient Excel skills. However, with dedication and practice, you can master it over time.

Is it worth to learn financial modeling?

Learning financial modeling is worth it if you’re pursuing a career in finance or business. It can help you make informed financial decisions and improve your job prospects in fields like investment banking, corporate finance, and corporate development.

Is financial modeling a hard class?

The difficulty of a financial modeling class can vary depending on your background in finance and your proficiency in Excel. You might find it challenging if you’re new to finance. However, with regular practice and study, you can master the skills needed for financial modeling.

Have any questions? Are there other topics you would like us to cover? Leave a comment below and let us know! Also, remember to subscribe to our Newsletter to receive exclusive financial news in your inbox. Thanks for reading, and happy learning!