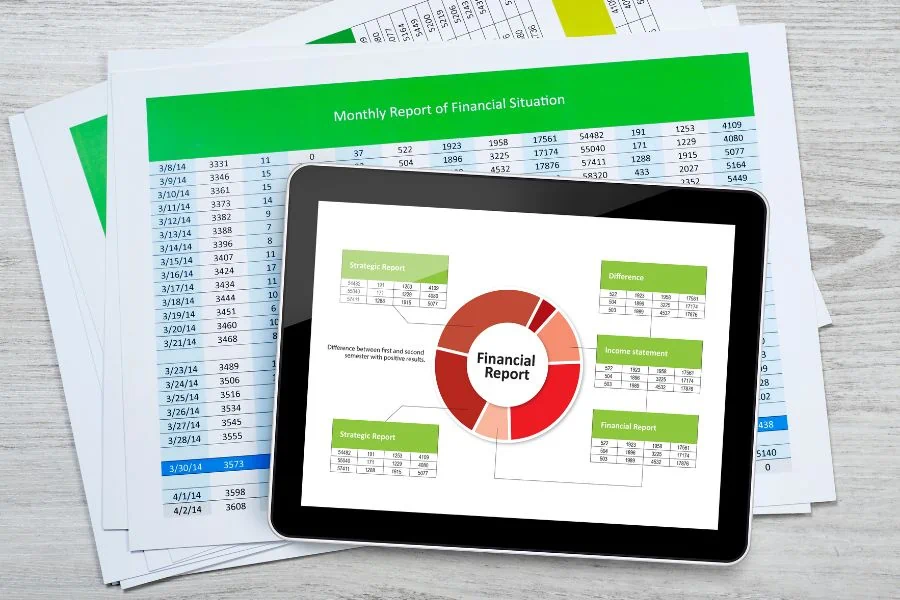

My 15 Favorite Strategies To Build Better Reporting In Finance

Dive into the world of financial reporting with my favorite tips to improve your reporting in finance. From data collection to storytelling and more.

Welcome to the US GAAP tag on F9 Finance’s blog – your friendly interpreter in the intricate world of Generally Accepted Accounting Principles. Whether you’re a corporate finance professional, a finance student, or a small business owner, we understand that US GAAP can seem like an intricate tapestry with its own unique patterns. But don’t worry! With our clear language, personal anecdotes, humor, practical advice, and relatable analogies, we’re here to turn your apprehension into appreciation.

Each post under our US GAAP tag is your personal interpreter, decoding the complex patterns of revenue recognition, asset classification, financial reporting, and more. Remember the exhilaration of understanding a complex pattern? That’s the feeling we aim to give you when mastering US GAAP. With each new principle you comprehend, you’ll gain more confidence, and soon, you’ll be interpreting the US GAAP tapestry like an expert!

We believe learning about US GAAP should feel like appreciating an intricate tapestry, not getting tangled in a web of complexity. Our posts break down complex topics into easy-to-understand steps, using relatable analogies and a dash of humor to keep things engaging and entertaining. So grab your magnifying glass, dive into our content, and let’s appreciate the beauty of US GAAP together!

Dive into the world of financial reporting with my favorite tips to improve your reporting in finance. From data collection to storytelling and more.

Choosing between Capital Expenditures (Capex) and Operational Expenditures (Opex) is more than an accounting preference—it’s a significant business decision that impacts your company’s flexibility, upfront costs, and long-term value.

Dive into the world of business finances with this comprehensive yet easy-to-follow guide on adjusted EBITDA. From step-by-step procedures to practical examples, we’ve got you covered. Let’s turn those numbers into financial success!

Discover the best small business accounting software that simplifies finance management, boosts productivity, and helps your business thrive. Whether you’re a start-up or an established enterprise, these tools are a game-changer for your financial landscape.

The accounting field is significantly transforming in an age of rapid technological advancement and changing regulations. My comprehensive guide unveils 17 key trends set to redefine accounting in 2023, offering you a closer look into your financial future.

Explore the transformative world of financial reporting software with us! Discover how these tools can streamline your financial management process, ensure compliance, and unlock your business’s financial potential. Read on to find out more!

Are you a business owner looking to understand receivables in accounting? We cover ASC 310, accounting for receivables, and managing cash flow.

The Public Company Accounting Oversight Board (PCAOB) recently proposed a standard, AS 1000, to revolutionize auditing. It would address the core principles and responsibilities of the auditor, such as reasonable assurance, professional judgment, due professional care, and professional skepticism. In addition, it would also amend some other standards related to fundamental audit responsibilities.

Are you a business owner or accountant looking to understand cryptocurrency accounting under US GAAP?

Dive into the world of cryptocurrency accounting with this comprehensive, yet easy-to-follow guide. Our friendly approach will take you from novice to pro, step-by-step, with real-life examples and official resources.

Individuals rely on personal financial statements for a variety of reasons, including assessing credit risk and determining whether to grant loans. In this blog post, we’ll provide an overview of ASC 274 and discuss some key concepts related to personal financial statements.

End of content

End of content

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.