My 15 Favorite Strategies To Build Better Reporting In Finance

Dive into the world of financial reporting with my favorite tips to improve your reporting in finance. From data collection to storytelling and more.

Dive into the world of financial reporting with my favorite tips to improve your reporting in finance. From data collection to storytelling and more.

Discounted Cash Flow (DCF) is essentially a method used by finance whizzes to determine the value of an investment today, based on projections of how much money it will generate in the future.

Data-driven decision-making is a process of using data and analytics to inform and guide business decisions. It involves collecting, analyzing, and interpreting data to gain insights that can drive strategic and operational decisions.

Scenario planning is a strategic planning method that organizations use to visualize possible future events and develop effective long-term plans. Think of the scenario planning process as storyboarding for your business, where you sketch out different plots (scenarios) and draft your actions (strategies) for each.

Discover how Cube transforms financial planning and analysis (FP&A) with its intuitive integration into Excel and Google Sheets, facilitating seamless workflows, enhanced reporting, and dynamic forecasting. This review explores Cube’s strengths, user experiences, and how it scales financial intelligence across organizations.

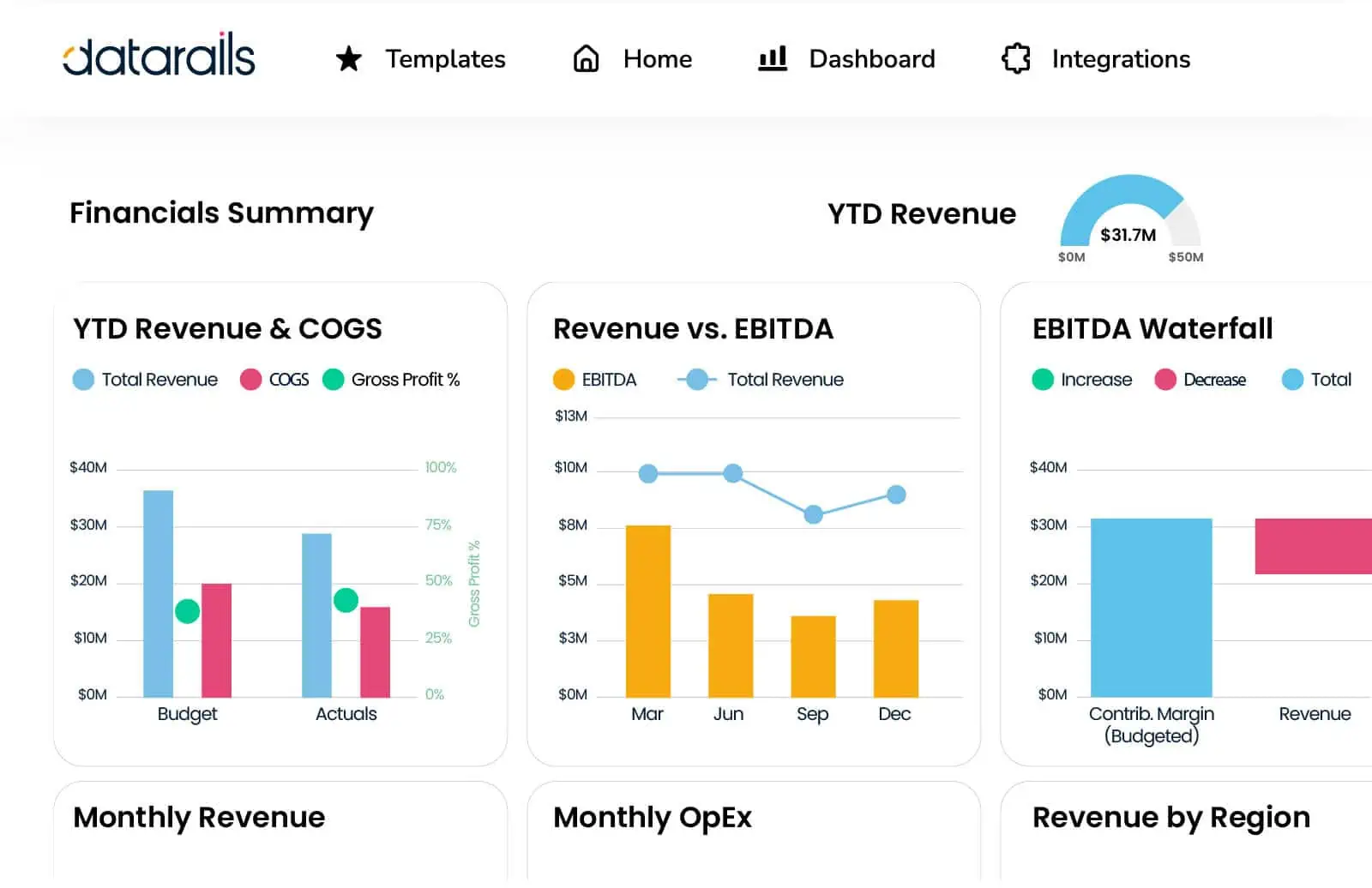

Dive into an in-depth review of DataRails, the FP&A software transforming the way small and medium-sized businesses manage their financial planning and analysis. With real-life examples and step-by-step walkthroughs, discover how this Excel-based platform revolutionizes reporting, budgeting, and forecasting, making it accessible and actionable for finance teams seeking efficiency and accuracy.

Dive into the world of business finance with our easy-to-follow guide. We’ll break down the steps to calculate contribution margin, complete with real-life examples and relatable analogies. By the end of this article, you’ll be a pro at understanding your business’s profitability.

Dive into the world of SaaS financial metrics and KPIs with me! This comprehensive yet easy-to-follow guide is packed with step-by-step instructions, real-world examples, and a dash of humor. Together, we’ll demystify finance and turn complex numbers into powerful tools for your business success.

Dive into the world of finance with our easy-to-follow, step-by-step guide on performing sensitivity analysis in Excel. Peppered with real-life examples, personal anecdotes, and practical advice, we’ll transform you into a skilled financial forecaster in no time.

Embark on your journey to becoming an FP&A Director with this comprehensive guide. From my own experiences, I’ll share the ins and outs, the highs and lows, and all the must-knows for your career progression.

End of content

End of content

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.