The Easy Guide To Calculating MACRS Depreciation In Excel

I don’t know about you, but the first time I heard MACRS, I thought there was a new fast-food restaurant in town. I was really surprised to learn that MACRS depreciation is another (much more complicated) way of depreciating assets compared to the straight line method I learned in School. I want to save you the time and trouble of going through what I went through, so I put together this easy guide to calculating MACRS depreciation in Excel.

So open up your sandwich, I mean spreadsheet (although I could go for a sandwich right now) and let’s get started!

Key Takeaways

Depreciation is a way of accounting for the decline in the value of an asset over time. Every asset has a certain useful life and, as such, depreciates over that period of time. Depreciation is used to spread out the cost of the item over its lifetime.

The Modified Accelerated Cost Recovery System (MACRS) is the most common method of depreciation used for tax purposes. It allows companies to calculate the annual depreciation expense of an asset and claim a tax deduction for that amount.

What Is Depreciation?

Depreciation is a way of accounting for the decline in the value of an asset over time. Every asset has a certain useful life and, as such, depreciates over that period of time. Depreciation is used to spread out the cost of the item over its lifetime.

For example, if you buy a computer for your office for $1,000, you can’t just deduct that entire cost in the year you buy it. Instead, you would calculate its depreciation over several years and deduct a portion of the cost each year until the computer is fully depreciated. This method allows businesses to spread out their expenses instead of taking a big hit all at once.

Depreciation is a non-cash expense that doesn’t directly affect a company’s cash balance. Instead, it reduces the company’s net income and its taxable profits for the year. This can help lower taxes due to the government in a given period.

Depreciation also helps businesses obtain a better estimate of their actual profits since it separates out the cost of investments made in fixed assets. This allows an accurate comparison between current and past financial performance.

Overview Of Depreciation Methods

You can calculate depreciation using several different methods, including straight-line, MACRS, and double declining balance. The decision of which method to use can have a major impact on the amount of depreciation recorded each year.

Straight-Line Depreciation

Straight-line depreciation is the most widely used method for calculating depreciation expense. It involves assigning an equal amount of depreciation expense to each year in the fixed asset’s useful life. US GAAP and IFRS both use the straight-line method. The accounting code for depreciation under US GAAP is ASC 360 – Property, Plant, and Equipment. Under IFRS, the code is IAS 16 – Property, Plant, and Equipment.

MACRS Depreciation

MACRS depreciation (short for Modified Accelerated Cost Recovery System) is the primary Tax depreciation method in the US. Congress put MACRS in place under the Tax Reform Act of 1986. MACRS accelerates depreciation, providing a larger tax deduction in the early years of an asset’s life. IRS Publication 946 covers the Tax code and calculations for the depreciation deduction surrounding the MACRS depreciation method.

There are two different depreciation methods under MACRS:

- General Depreciation System (GDS) – The standard method under MACRS

- Alternative Depreciation System (ADS) – The ADS method calculates depreciation using a straight-line method over a longer period of time relative to GDS

Double Declining Balance Depreciation

A third depreciation method, the double declining balance method, is used for assets that depreciate rapidly in the early years of life. The declining balance method allows for 150%, 200%, or 250% of the straight-line rate depreciation rates. If you choose the 200% rate, the double rate, you use the double-declining balance method. With this method, the double rate remains constant and is applied to the decreasing book value each depreciation period. The asset’s book value (or depreciation base) decreases as time passes.

Calculating MACRS Depreciation In Excel

The Modified Accelerated Cost Recovery System (MACRS) is the most common method of depreciation used for tax purposes. It allows companies to calculate the annual depreciation expense of an asset and claim a tax deduction for that amount. Excel isn’t set up to calculate depreciation out of the box, but our easy-to-use Excel depreciation calculator can help!

Excel MACRS Depreciation Calculator

How Is MACRS Depreciation Calculated?

Here are the MACRS depreciation calculations that underlie our Excel calculator:

1st Year Depreciation = Cost x (1 / Useful Life) x Depreciation Method x Depreciation Convention

Subsequent Years Depreciation = (Cost – Depreciation in Previous Years) x (1 / Recovery Period) x Depreciation Method

MACRS Depreciation Conventions

Mid-Month Convention: The taxpayer uses straight-line depreciation to calculate the depreciation of their real property. This is based on the number of months that the property is in service. For the month the property is placed in service, the taxpayer takes a one-half month of depreciation. Similarly, for the month in which the property is removed from service, one-half month of depreciation is taken.

Mid-Quarter Convention: If over 40% of the personal property that can be depreciated is used during the year’s final quarter, the taxpayer must apply the mid-quarter convention.

Half-Year Convention: For personal property, there’s a half-year convention that applies. This means that if you put an asset into service or dispose of it during a taxable year, it’s considered to have been put into service or disposed of at the midpoint of the year. So, if you put an asset into service at the beginning of the tax year, you only need to take a half year of depreciation expense against your taxable income.

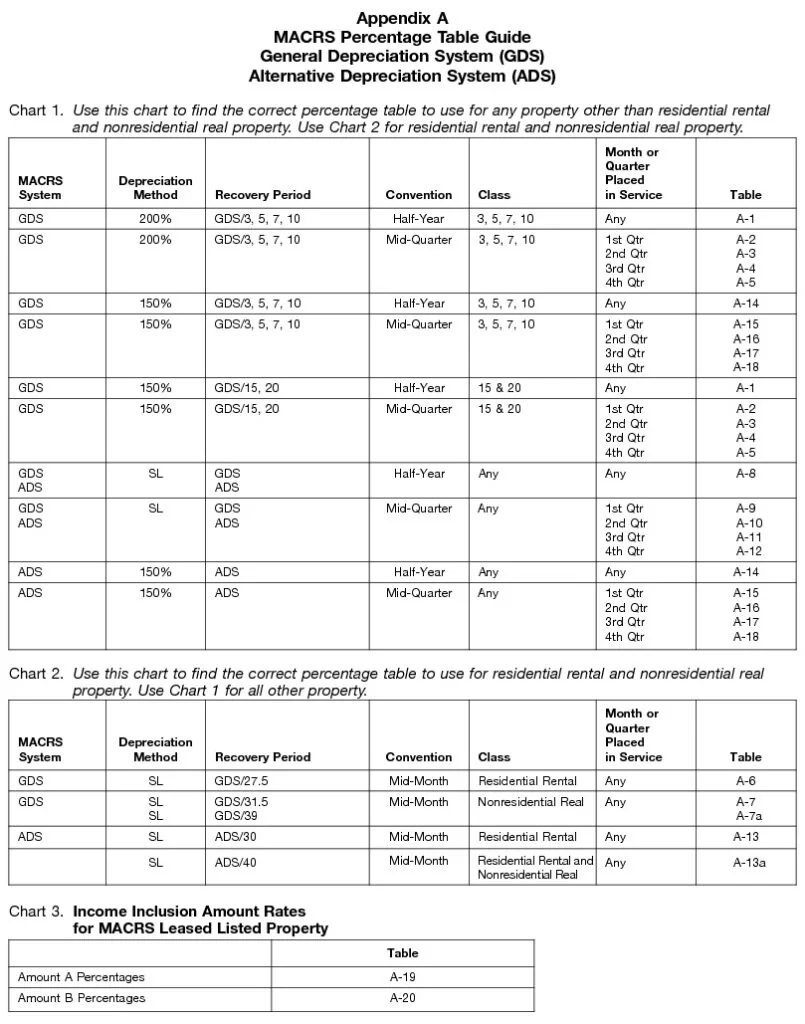

Depreciation Tables, Depreciation Methods, And Recovery Periods

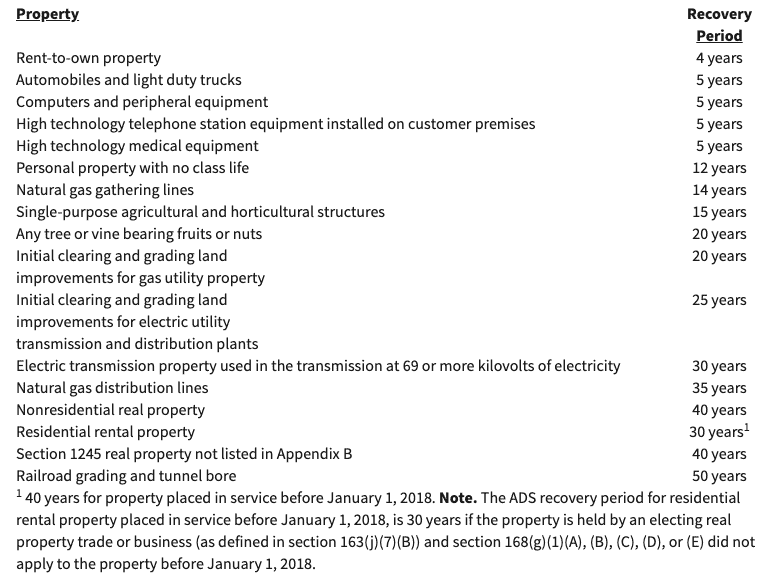

Recovery Periods

The IRS has determined a recovery period for nearly every type of asset. The recovery period is the number of years you must spread out your depreciation expense. Generally, the recovery period starts when the asset is put into service and ends when it’s fully depreciated.

Depreciation Methods

Depending on the asset class, there are three depreciation methods; the IRS will tell you which ones can be used for your asset class in IRS Publication 946.

- Straight-Line

- 150%

- 200%

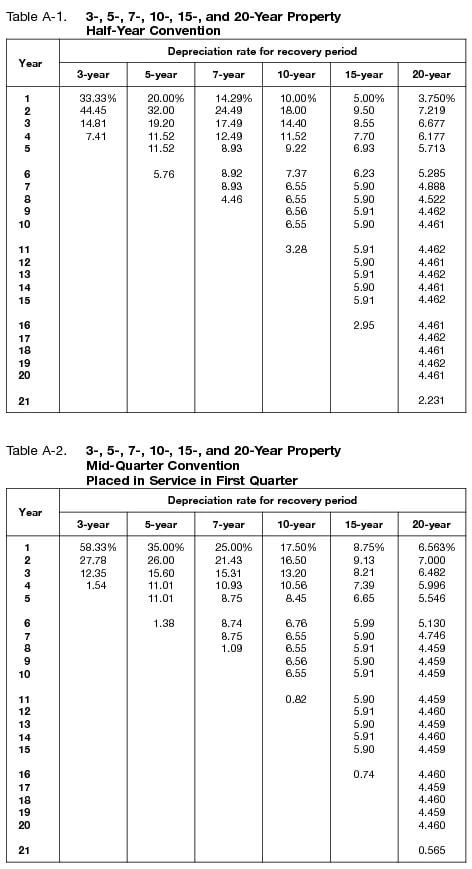

MACRS Depreciation Schedule

The Modified Accelerated Cost Recovery System (MACRS) depreciation schedules are predetermined tax tables that list the annual deduction for each year of ownership for specific asset classes. These MACRS depreciation tables are based on the recovery period, which is determined by the IRS and assigned to an asset class based on its expected useful life.

There are many depreciation tables in appendix B of IRS Publication 946, here is an example of what they look like:

Additional Inputs

Tax Basis (Asset Cost): The most critical input for depreciation is the cost basis of your asset. In the simplest terms, this is the purchase price of the asset plus sales tax, freight, and installation.

Date in Service: The in-service date will not change the calculation, but it is helpful to align the depreciation timeline with a calendar for forecasting purposes.

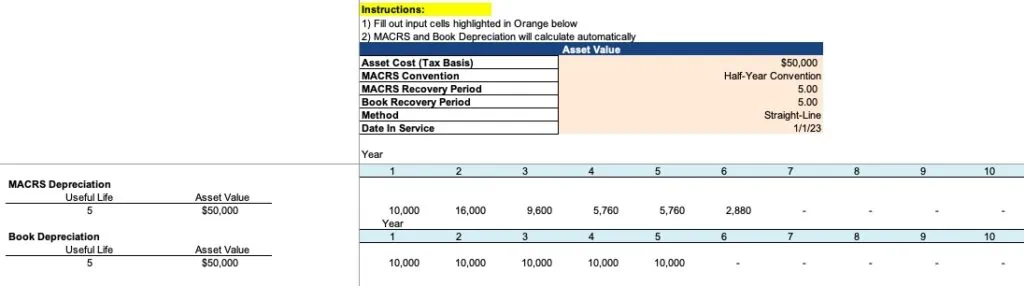

Example: Calculating MACRS Depreciation for a Fleet Vehicle

In this example, we want to evaluate the purchase of a fleet vehicle. First, let’s collect our assumptions and then move them into the depreciation spreadsheet in Excel. It is critical to keep Excel workbooks organized, and we set up the Excel depreciation calculator to make things easy.

Basis – Let’s assume the fleet vehicle will cost $50,000, including Tax and Delivery.

MACRS Convention – We will use the half-year convention, which is the most common depreciation convention

MACRS Recovery Period – Based on the IRS table above, vehicles have a recovery period of 5 years.

Book Recovery Period – Sometimes, Tax and Accounting depreciation use different lives. In this case, they are both five years.

Method – We will use the straight-line method

Date in Service – The in-service date will be January 1st, 2023.

Here is what the inputs table looks like:

Once you fill out the inputs, the calculator automatically gives you your asset’s MACRS and Book Depreciation schedules.

Have any questions on calculating MACRS depreciation in Excel? Are there other topics you would like us to cover? Leave a comment below and let us know! Make sure to subscribe to our Newsletter to receive exclusive financial news right to your inbox.

Hello,

I downloaded your excel workbook to calculate depreciation. The input cells highlighted in orange whenever I change the drop down boxes for MACRS Convention, MARC Recovery Period, Book Recovery Period, Method, or Date in Service nothing changes in the calculated amounts below. Is that correct?

Thank you,