The Easy Guide To Small Business Forecasting

Ah, I remember it like it was yesterday. The first time I dabbled in small business forecasting, I felt like a sailor lost at sea without a compass. My small business, a small travel agency, was just taking off. I had the passion and the itineraries, but when it came to predicting the financial waves of the future, I was all at sea.

Armed with nothing more than a calculator and a notepad filled with numbers that looked as complicated as a grandma’s knitting pattern, I decided to take on the challenge of financial forecasting. Let me tell you, my friends, those first few attempts were about as successful as a chocolate teapot. But, as they say, what doesn’t melt your teapot makes you stronger!

Now, why am I sharing this somewhat embarrassing tale? Well, it’s because understanding and mastering financial forecasting is crucial for every small business owner, just like you and me. It’s our compass in the sea of business uncertainties. It helps us navigate through stormy economic weather, spot the sunny opportunities, and keep our businesses sailing smoothly towards success.

So, let’s demystify this financial forecasting business together, shall we? By the end of this guide, I promise you’ll be navigating your business finances with confidence and perhaps even a smile. After all, if I could do it while juggling doughnuts and spreadsheets, so can you!

Key Takeaways

A financial forecast for a small business is a projection of your future financial performance based on your past data, market trends, and business plans. It typically includes forecasts for revenue, expenses, cash flow, and profitability. Think of it as your business’s weather forecast – it helps you anticipate sunny days (profitable periods) and weather storms (financial challenges).

To create a business forecast, follow these steps:

- Gather your historical financial data.

- Identify patterns and trends.

- Set realistic financial goals.

- Make informed predictions about your future revenue, expenses, cash flow, and profitability.

- Compile your data and predictions into a clear, concise forecast.

- Regularly review and adjust your forecast based on your actual performance and changing market conditions.

Understanding Financial Forecasting

Imagine you’re about to embark on a road trip. You have your bags packed, your favorite playlist ready, and a heart full of excitement. Now, would you set off without a clear route or an idea of what the journey will look like? Probably not. You’d likely use a GPS or a good old-fashioned map to plan your way, foresee potential traffic jams, be aware of detours, and ensure a smooth, enjoyable ride. That, my friends, is what financial forecasts are all about – it’s the GPS for small businesses.

A financial forecast is your business’s roadmap, laying out the financial route your company plans to take in the future. It helps you anticipate revenue, control expenses, manage cash flow, and maximize profitability. It’s not about predicting the future with absolute precision – it’s about being prepared and making informed decisions.

Now, let’s talk about why financial forecasting is a non-negotiable for small businesses. Remember my little travel agency? When I first opened the doors, I thought forecasting was only for big corporations with complex operations. Little did I know, my small business had its own share of complexities!

Take, for instance, the lag in payment from making a sale to getting paid. Without a forecast, I wouldn’t have known that if a customer was booking a cruise in a year I won’t see payment for 9-10 months! My first year could have been a disaster waiting for money that didn’t, but thanks to sales forecasting, it was a success.

These real-life examples show that whether it’s managing seasonal fluctuations, planning for growth, or navigating through unforeseen challenges, financial forecasting is a vital tool for all small business owners. It’s like having a crystal ball that, while it might not show you the exact future, gives you a pretty good idea of what to expect and how to prepare for it.

The Basics of Small Business Forecasting

If financial forecasting is our GPS, then revenue, expenses, cash flow, and profitability are the four cardinal directions that guide us on our journey. Let’s break down these key components of financial planning, shall we?

- Revenue: This is the lifeblood of your business – the total amount of money your business brings in by selling its products or services. Think of it as the fuel that powers your business vehicle. To do a sales forecast, look at your sales history, market trends, and growth plans. If you’re a new business without a sales history, research your industry and competitors to make an educated guess for your future business.

- Expenses: These are the costs associated with running your business. It’s like the tolls and gas money on your road trip. From rent and salaries to marketing and supplies, expenses eat into your revenue. So, keep a close eye on them! Your past expense records and future plans will help you predict this.

- Cash Flow: Cash flow is the money that flows in and out of your business. Imagine it as the traffic on your business highway. Positive cash flow means more money is coming in than going out (green light), while negative cash flow is the opposite (red light). Your cash flow forecast should account for when and how much cash comes in from sales and goes out for expenses.

- Profitability: This is what’s left after you subtract your expenses from your revenue. It’s like the scenic views and memorable experiences on your road trip – the ultimate reward! Forecasting profitability helps you assess if your business is financially viable and sustainable in the long run.

Now, you might be wondering, “Where do I gather all this data for my forecast?” Well, your business’s past performance is your goldmine. Income statements and your cash flow statement hold valuable information about your sales, costs, and cash flow patterns. Don’t have past records? No worries! Industry reports, competitor analysis, and market research can provide valuable insights.

Remember, your forecast doesn’t have to be perfect. It’s okay if your actual numbers don’t match your predictions down to the last penny. The goal of forecasting is not perfection but preparation. So, put on your financial explorer hat, and let’s dive into the exciting world of small business forecasting!

Step-by-step Guide to Creating a Financial Forecast

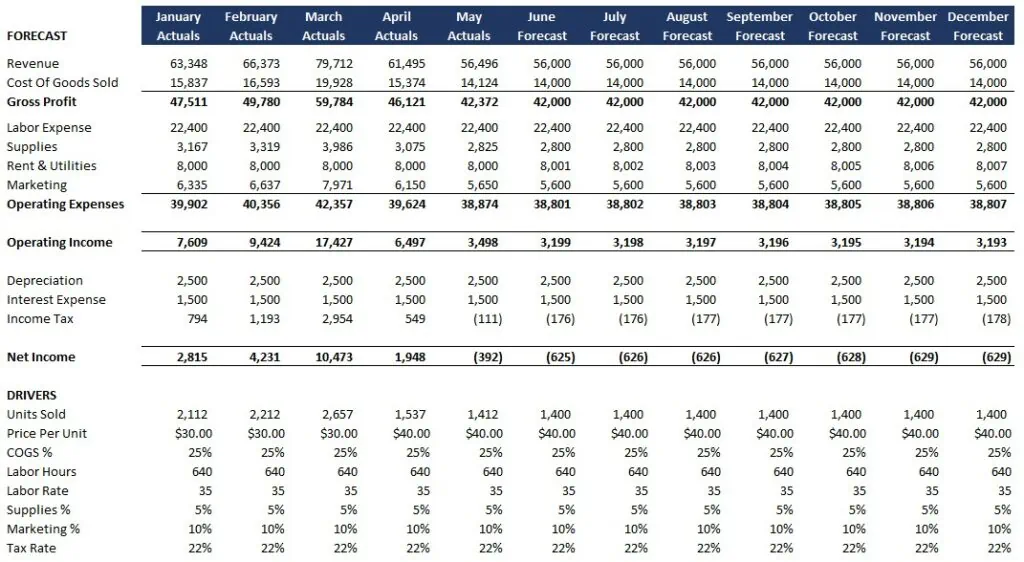

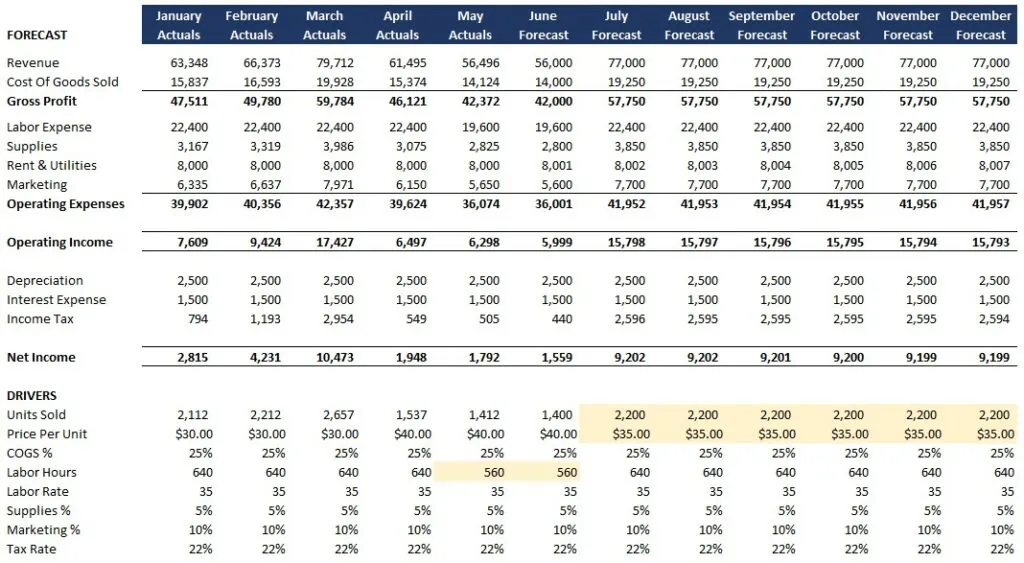

Make sure to download our free excel template for small business forecasting so you can follow along!

Step 1: Establish Your Financial Goals

First things first, let’s talk about goals. Now, I remember when I first started my travel agency, my business strategy was to outsell the big-name agency in town – in my first month! Talk about shooting for the stars, right?

Well, needless to say, I quickly learned that setting unrealistic goals is like trying to bake a cake in a toaster – it’s just not going to work out. Instead, focus on setting SMART (Specific, Measurable, Achievable, Relevant, and Time-bound) goals. They’ll provide a clear direction for your business and serve as the foundation for your financial forecast.

Step 2: Analyze Historical Data

To predict where we’re going, we need to understand where we’ve been. This is where historical data comes in handy. It’s like the secret ingredient in grandma’s apple pie recipe – it can make all the difference. Your past sales, expenses, and cash flow data are your best friends here.

Open up your accounting software and dig into your historical financial statements, invoices, and receipts. If you’re a new business, don’t fret! Look at industry reports and competitor data. Remember, the goal is to identify patterns and trends that will help you forecast your financial future.

Step 3: Predict Future Trends

Now that we have our past data in hand, it’s time to put on our fortune teller hats and predict future trends. For instance, a clothing retailer might anticipate higher sales during the holiday season, while a landscaping company might expect a slowdown in winter. Similarly, a coffee shop might foresee higher operating expenses when coffee bean prices rise globally. These predictions, based on market trends, seasonal cycles, economic indicators, and your business plans, will guide your sales forecasting.

Step 4: Create Your Forecast

We’ve reached the exciting part – putting it all together to create your forecast. Start with your sales forecast by projecting your revenue based on your sales trends and goals. Next, estimate your expenses, considering both fixed costs (like rent) and variable costs (like supplies). Then, forecast your cash flow by analyzing when and how much cash will come in and go out. Finally, subtract your projected expenses from your projected revenue to forecast your profitability.

It’s like baking a cake – gather your ingredients (data), follow your recipe (methodology), and voila, you have your delicious forecast ready!

Step 5: Review and Adjust Your Forecast Regularly

Creating your forecast is not a one-and-done deal. It’s more like kneading dough – you’ve got to keep working on it. The business climate changes constantly, and your forecast should reflect that. Make it a habit to review and adjust your forecast regularly, perhaps monthly or quarterly. This way, you’ll always have an up-to-date roadmap for your business journey.

And remember, it’s okay if your actual results don’t match your forecast perfectly. The goal is to learn, adapt, and improve over time, just like perfecting a recipe.

Common Mistakes in Financial Forecasts and How to Avoid Them

I’ll be honest with you – financial forecasts, like baking a soufflé, can be a bit tricky. But don’t worry, I’ve got your back! Let’s take a look at some common pitfalls and how to avoid them so that your forecast doesn’t fall flat.

Being Too Optimistic

It’s natural to have high hopes for your business, but overestimating your revenue or underestimating your expenses can lead to problems down the road. To avoid this, use realistic assumptions based on your historical data and market trends.

Ignoring Seasonality

My travel agencies sales skyrocketed during the holiday season. If I ignored this seasonal trend in my forecast, I’d be in for a rude surprise. So, make sure to account for seasonal fluctuations in your sales forecast and expenses.

Forgetting About Cash Flow

Profitability is great, but without positive cash flow, your business could run into trouble. It’s like having a fridge full of ingredients but no gas to cook! So, always keep an eye on when cash will come in from future sales and when it will go out for expenses.

Setting It and Forgetting It

Your financial forecast is not a tattoo – it’s not permanent! The business world is always changing, and your forecast should reflect that. Regularly review and update your forecast bringing in past and present data to keep it fresh and relevant.

Quick Recap

Well folks, we’ve been on quite a journey today, haven’t we? From the nitty-gritty of revenue, expenses, cash flow, and profitability to the step-by-step guide to creating a financial forecast, we’ve covered a lot of ground. But remember, all these are milestones on the road to mastering the art of financial forecasting for your small business.

Why bother, you ask? Well, sales forecasting is like your small business’s crystal ball. It helps you anticipate future trends, make informed decisions, manage your resources effectively, and ultimately, steer your business towards success. It’s like the secret sauce in your entrepreneurial recipe!

Take it from me. When I started my travel agency, I was more comfortable with cruise ship itineraries than balance sheets. But as I got the hang of financial forecasting, things started to change. I could plan for the busy spring break season, manage my cash flow during the slow months, and even turn a tidy profit! I won’t lie – it wasn’t easy. But boy, was it worth it!

Frequently Asked Questions

What are the 4 forecasting methods?

The four main forecasting methods used in business are:

- Qualitative Forecasting: This forecasting method relies on expert opinions and market research. It’s like asking a master chef for cooking tips – you’re leveraging their knowledge and experience.

- Time Series Analysis: This method uses historical data to identify patterns and trends. It’s like looking at old family photos to predict how your kids might look when they grow up.

- Causal Models: This method assumes that the variable you want to forecast (like sales) is affected by other variables (like marketing spend). It’s like baking a cake – the quality of your ingredients (variables) affects the outcome (forecast).

- Simulation Methods: This method uses computer models to simulate different scenarios. It’s like playing a video game – you can explore different outcomes based on different actions.

What is an example of a company forecast?

Let’s say you run a small landscaping business. Based on your past sales, seasonal trends, and upcoming contracts, you predict that your revenue will increase by 10% next year. You also anticipate that your expenses (like labor and materials) will rise due to inflation, but you plan to offset this by raising your prices slightly. After crunching the numbers, you forecast a 7% increase in profitability for the next year. That’s a simplified example of a company forecast!

Have any questions? Are there other topics you would like us to cover? Leave a comment below and let us know! Make sure to subscribe to our Newsletter to receive exclusive financial news right to your inbox.